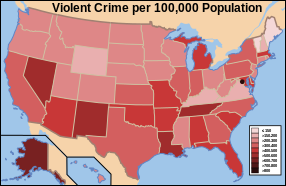

Crime is a common concern regarding immigration among US restrictionists. The statistics on immigration and crime in the United States show pretty clearly that as things stand today, the foreign-born have lower crime rates than natives both in total and for every ethnicity and for every combination of ethnicity and high school graduation status. Nathan recently blogged about how immigration might also indirectly reduce native crime rates. So, restrictionists need not be worried about immigrant crime under the status quo.

But there’s still the concern about radical open borders to contend with: even if restrictionist concerns about immigrant crime are misplaced at current rates of migration, the concern may still be valid for truly open borders. Is it? It’s hard to say anything definitive, so if you believe in the precautionary principle, this is a slam dunk argument against open borders. However, I will try to argue in this post that there is no strong reason to believe that open borders would lead to a significant upward trend in US crime rates. In fact, I would say that the odds of crime rates going up versus down are about even, and they almost certainly will not explode.

The first point I will make is that even under the current highly restrictive immigration laws, there is some immigration, including “low-skilled” immigration, to the United States from all parts of the world. While border-crossing from Mexico forms the lion’s share of “low-skilled” immigration to the United States, there are also a few low-skilled work visas and, more importantly, a diversity visa that is not designed to pick out high-skilled workers but rather favors countries that send few immigrants to the United States. Thus, the current data on immigration and crime in the United States does shed some light on what might happen under a radically freer migration regime.

However, I will, for the moment, set this point aside. Assume for the moment that current immigration from a country is completely unrepresentative of what immigration from the country would look like under open borders. What method can we then use to approximate crime rates for immigration from that country? We could look at average crime rates in the sending country. I would argue that this would overestimate their crime rates in the United States for three reasons: Continue reading Crime in the US under open borders